(London, UK) COVID-19 has brought about many changes in consumer behaviour and issuer offerings. Auriemma Group’s 2020 Cardbeat UK Trend Report identified four areas where shifts were most prominent, highlighting the impact that the pandemic has had on the payment’s ecosystem for both financial institutions and cardholders alike.

1. New card acquisition, spend amounts and card usage have declined.

Cardholders were less engaged with their existing products and fewer sought new products compared to prior years. According to Auriemma’s research, new card acquisition dropped nearly 50%, with only 10% of UK credit cardholders in Q4-20 saying they acquired a new credit card in the past 18 months, down from 18% the same time the year prior.

“Consumers and issuers kept focus on current offerings,” says Jaclyn Holmes, Director at Auriemma Group. “During this period, issuers recognized their efforts were best spent building meaningful and productive engagement with their existing customers. For cardholders, it was critical that they got the most out of their existing products and kept on top of the various solutions that were being presented to them.”

Cardholder spend across payment methods declined from Q4-19 to Q4-20, coinciding with a drop in usage among heavy top of wallet card users. By the end of 2020, UK cardholders reported £854 in average monthly spend, down from £988 the year prior. Meanwhile, the proportion of cardholders who use their most frequently used card 20+ times in a typical month decreased over the same period (30% vs. 22%).

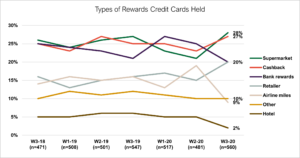

2. Types of rewards cards held shifted away from T&E and towards day-to-day rewards.

The impact of travel restrictions and stay-at-home guidance was felt most prominently in the T&E space. Over 2020, the types of rewards cards held shifted to align with new consumer spend patterns due to COVID-19. Ownership of supermarket co-brand (from 21% in July 2020 to 28% by November) and cash back cards (23% to 27%) rose, as co-branded airline (19% to 9%) and hotel card (5% to 2%) ownership trended down.

“While rewards card ownership shifted towards the end of 2020, and travel naturally became a lesser focus given the obvious limitations, our research found that most T&E cardholders still enjoy earning travel rewards” says Holmes. “These cardholders currently prefer redeeming their rewards for non-travel benefits, but we anticipate travel-centric redemption will bounce back as travel becomes more routine.”

Auriemma recently covered COVID-19’s impact on travel and consumer loyalty in-depth here.

3. Payment holidays became a commonplace issuer-provided relief option.

COVID-19 impacted some cardholders earning potential, leading issuers to develop payment accommodations, including payment holidays, for those unable to make their payments. Despite being a new concept to many, credit card payment holidays had strong consumer awareness by Q4-20 (94% aware), and nearly one-quarter of those offered the option took it.

Future interest was rather low (17%), signalling that the accommodation–which was intended to be a temporary, short-term solution–likely will not be missed post-pandemic. In fact, 58% of cardholders were ambivalent or would not be disappointed if payment holidays were no longer an option in the future.

“We’ve passed the March 31st deadline for cardholders to enrol in payment holidays, so issuers are now preparing for a possible increase in delinquency volume. Most cardholders aren’t expecting to rely on a future payment holiday, but there will be a group who aren’t able to jump back into their payments and will seek alternative accommodations to help make ends meet,” says Holmes.

The government has already shared guidance for such a program. Breathing Space, enacted May 4th of this year, provides a 60-day freezes on interest, fees and enforcement for people in problem debt. The program is expected to bring in £400 million in extra repayments in the first year, ultimately extending upon the improvements made with persistent debt figures throughout 2020.

Auriemma covered payment holidays and Breathing Space in greater detail here.

4. Reduced spend and focus on paying down balances led to fewer in persistent debt.

While shifting finances were a hallmark of COVID-19, reductions in spend and access to payment accommodations led some to improve their financial positions. Auriemma found that the number of cardholders in persistent debt decreased from 7% in Q4-19 to 3% by Q4-20, likely because cardholders were able to focus on paying down their balances without compounding interest slowing them down.

“COVID-19 had the potential to worsen persistent debt, but a combination of cardholder thriftiness and payment accommodations created an environment where consumers could improve their financial standing instead,” says Holmes. “However, as payment holidays come to an end and spend levels return to pre-pandemic levels, we’ll see if this change, along with the others that emerged in the shadow of COVID-19, is long-lasting or temporary.”

Survey Methodology

Cardbeat UK

This Auriemma Group study was conducted online within the UK by an independent field service provider on behalf of Auriemma in November 2020, among 845 adult credit cardholders. The number of interviews completed is sufficient to allow for statistical significance testing between sub-groups at the 95% confidence level ± 5%, unless otherwise noted. The purpose of the research was not disclosed nor did the respondents know the criteria for qualification. The average interview length was 21 minutes.

About Auriemma Group

For more than 30 years, Auriemma’s mission has been to empower clients with authoritative data and actionable insights. Our team comprises recognised experts in four primary areas: operational effectiveness, consumer research, co-brand partnerships, and corporate finance. Our business intelligence and advisory services give clients access to the data, expertise and tools they need to navigate an increasingly complex environment and maximise their performance. Auriemma serves the consumer financial services ecosystem from our offices in London and New York City. For more information, call Jaclyn Holmes at +44 (0) 207 629 0075.